This is the cash back credit card I'd get instead of Apple Card

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. iMore may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

Apple Card is an incredibly bold move by Apple to upend a notoriously greed-stricken of the financial services industry. Credit cards are mostly known for hidden fees and high interest rates, all the while trying to be as vague as possible when it comes to understanding how much interest you are actually paying on each payment you make, as well as the interest you are paying over the long term on a card you are carrying a balance. Apple hopes to turn the tables with a credit card that touts no fees, reasonable rewards, and money management tools so you can make better decisions when using a credit card as part of your financial life.

I am incredibly excited to see the impact that Apple Card is going to have on the credit card industry and our financial health. That said, is the Apple Card the only one that does this? Or is there another card already in existence that brings the same or better rewards, is equally as transparent, and also makes understanding and managing your credit card usage easy? More simply put: is there already a credit card that puts the interests of the consumer first? After having used this card for five years, I can say the answer is yes, and is the card that I would get instead of Apple Card.

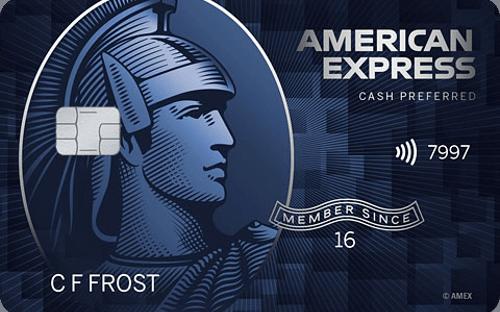

The Blue Cash Preferred® Card from American Express

I have been using the Blue Cash Preferred® Card from American Express as my main, and most of the time only, credit card for five years now. It has by far the most compelling cash back offer I have ever seen with rewards categories that are sure to apply to anyone who uses it.

This card gets you 6% cash back at U.S. supermarkets (up to $6,000 per year then 1%), 3% cash back at U.S gas stations, and 1% cash back on all other purchases. Unlike Apple Card, you'll earn a valuable sign-up bonus to the tune of a $250 statement credit after you spend $1,000 within the first 3 months. There is also a 0% intro APR on purchases and balance transfers for 12 months, then a variable APR, 15.24% to 26.24%.

The Blue Cash Preferred® Card from American Express effectively triples the amount of money you earn on groceries and gas when compared to Apple Card (assuming your gas stations are not Apple Pay ready). The bonus offer is relatively easy to qualify for, and Amex Offers provides savings at hundreds of retailers when you activate the offer and use your card to purchase. These, along with a 0% intro APR offer and best in class customer service make the Blue Cash Preferred® Card from American Express a compelling choice over Apple Card.

The app is the best around

The Amex app is by far the best credit card app experience I have found on iOS (it actually ranks highest in customer satisfaction among mobile apps according to JD Power & Associates). I'm able to do everything I need to within the app like checking my transaction history, activating bonus offers, redeeming rewards, and it all happens in a beautifully designed and easy to use interface. The app works with Face ID, so logging in to access all of this is a total breeze. The app also sets your card up to work with Apple Pay and even sends me notifications every time I make a purchase, so I can be confident that I'm always monitoring and protected against fraud.

A ton of other benefits

The Blue Cash Preferred® Card from American Express also gives owners of the card a plethora of other perks. Travelers can benefit from car rental loss and damage insurance, accident insurance, roadside assistance, and a global hotline built to connect to an expert for help in a number of emergency situations. Shoppers get access to 2 years of additional warranties, return protection up to 90 days, and theft and accidental damage protection for phone purchases up to 120 days. All customers also get ShopRunner, an expedited shipping service, and Entertainment Access for exclusive presales to concerts, sporting events, and more.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

But it has an annual fee!

Yes, the Blue Cash Preferred® Card from American Express does have a $95 annual fee, so Apple Card definitely beats it there with it featuring no annual fee whatsoever. So, why is this card worth it when you have to pay almost $100 a year to have it? Because of math! Let's take a look at a hypothetical spending scenario:

- $100 a week on groceries

- $50 a week on gas

- $100 a week on other purchases

If you were lucky and able to make every purchase with Apple Pay, Apple Card would earn you 2% and about $260 a year. That same scenario, even when subtracting the $95 annual fee, would still earn you $347 with the Blue Cash Preferred® Card from American Express, without the need to use Apple Pay. You can also make use of both the $250 bonus offer and the 0% intro APR for the first 12 months. So, in the first year your rewards now jump to $547, over twice as much as Apple Card and all interest-free.

So, why wait for Apple Card?

There are some features that will be unique to Apple Card, at least at first. All management of the card will happen inside of the Wallet app, which is slightly more convenient than having to download a third party app. Daily Cash will bring the fastest delivery in rewards, depositing your cash back onto your Apple Pay Cash card every day. It also features one of the best privacy policies in the industry, not allowing any of your information to be sold to advertisers.

However, if you are happy to manage your credit card in an award-winning app and can manage a little more patience in waiting to receive your cash back, you can not only earn considerably more money but get access to a host of additional rewards with the Blue Cash Preferred® Card from American Express. Take the time to run the numbers - you'll be surprised by how much more you can earn.

Joe Wituschek is a Contributor at iMore. With over ten years in the technology industry, one of them being at Apple, Joe now covers the company for the website. In addition to covering breaking news, Joe also writes editorials and reviews for a range of products. He fell in love with Apple products when he got an iPod nano for Christmas almost twenty years ago. Despite being considered a "heavy" user, he has always preferred the consumer-focused products like the MacBook Air, iPad mini, and iPhone 13 mini. He will fight to the death to keep a mini iPhone in the lineup. In his free time, Joe enjoys video games, movies, photography, running, and basically everything outdoors.