With its new Apple Savings account, Apple is one step away from being your bank

The checking account is all that's left.

Apple might be the first technology giant to convince everyone to bank with them.

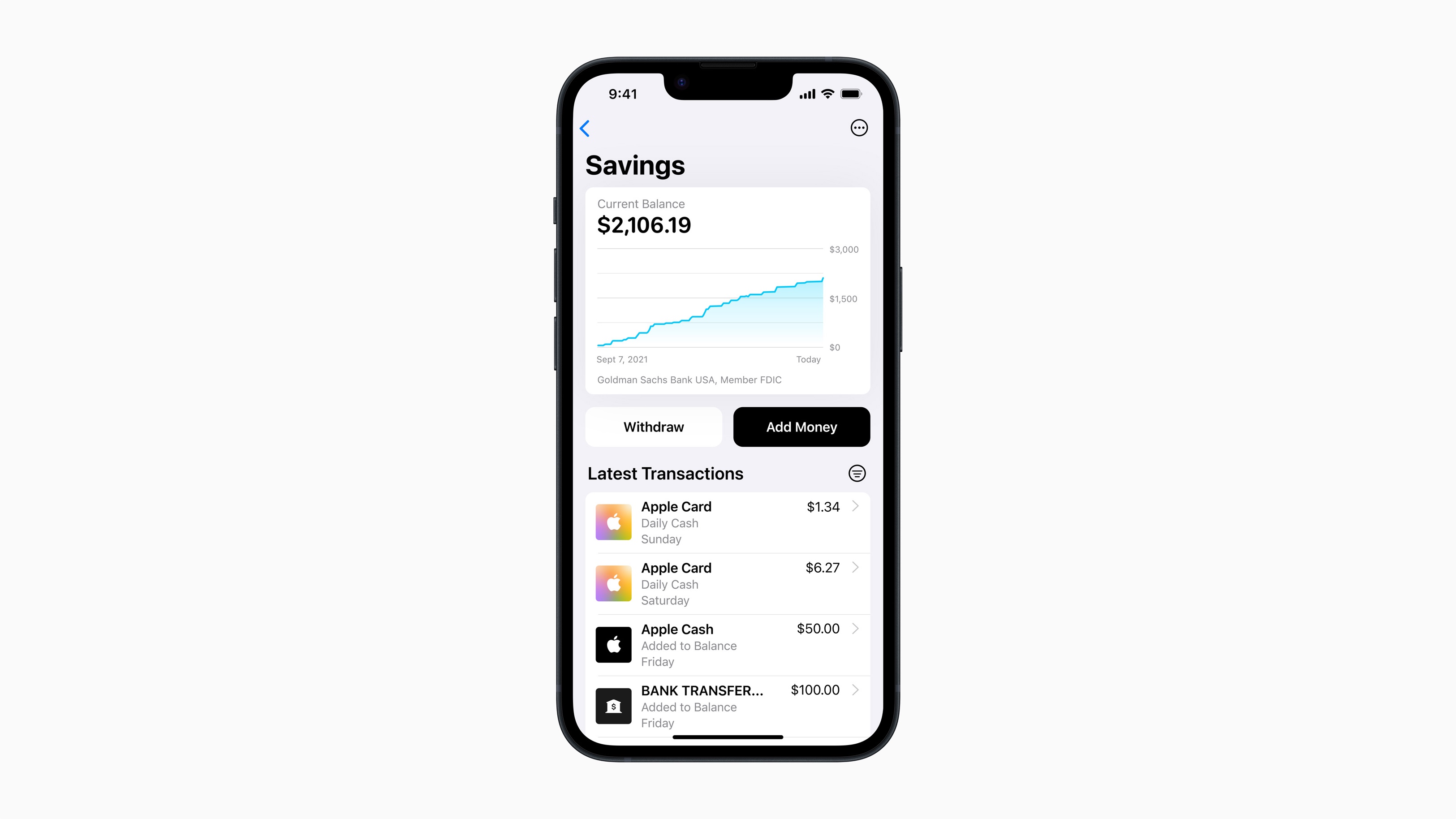

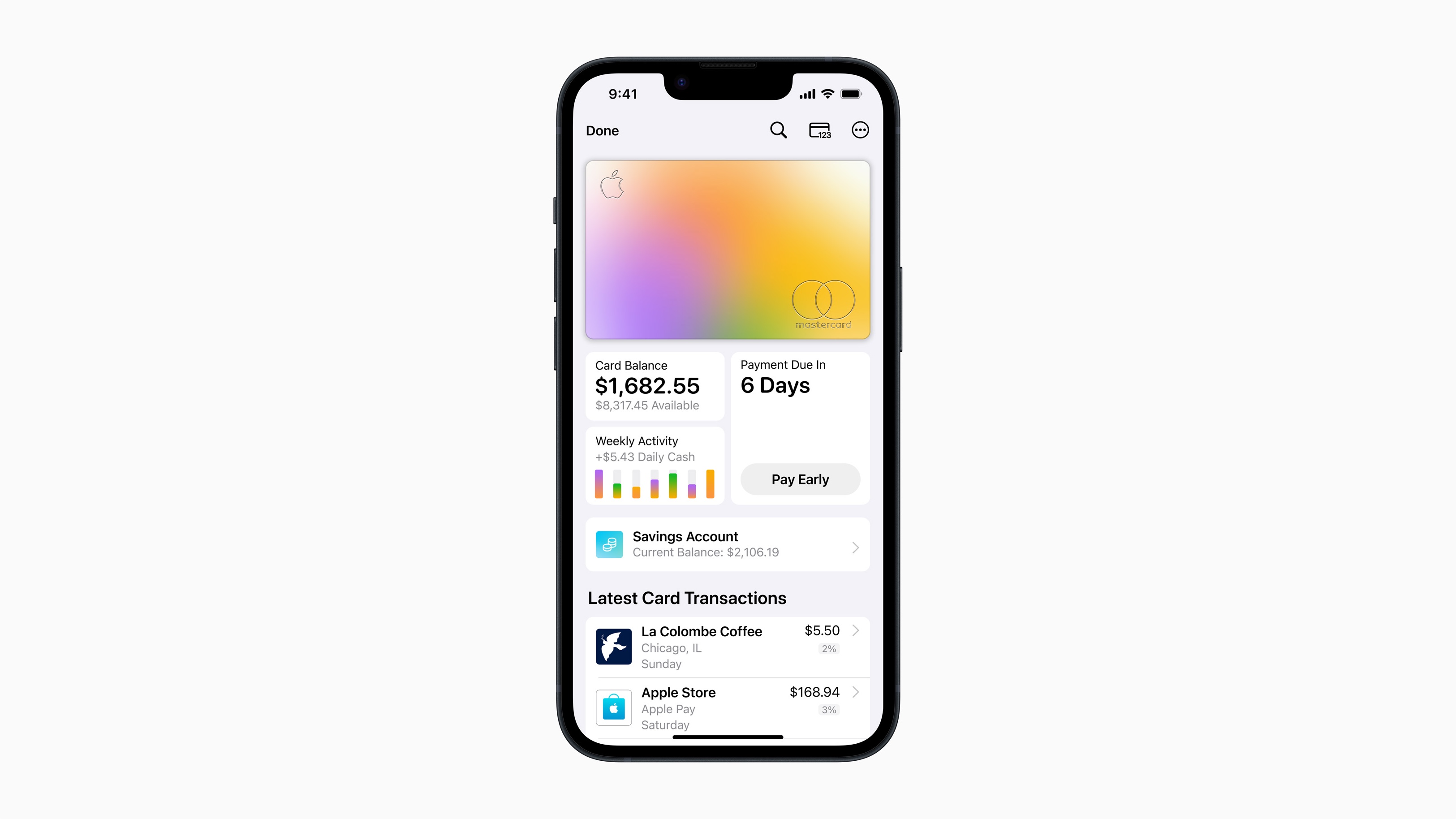

Last week, the company announced Apple Savings, a new savings account for customers who have an Apple Card, the company's self-branded credit card. The account, which will launch "in the coming months," is being pitched as a better place to house the Daily Cash that you earn with your Apple Card.

Apple says that its Savings account will earn "high-yield interest" that, if Goldman Sachs' savings account under its consumer brand Marcus gives us a hint (Goldman is Apple's partner for Apple Card and Apple Savings), could come in around 2.35% APY. In addition to automatically adding your Daily Cash to the account if you so chose, you can also deposit additional funds from your Apple Cash card or linked bank account to take advantage of that interest.

The pitch sounds pretty contained, right? It's simply a savings account you can add if you already have an Apple Card to earn more interest off of your Daily Cash.

I think there's a lot more long-term calculation to this move. Apple, with the rollout of Savings, is one step away from being your primary bank.

The proof is in the history

Apple has been building around a checking account for years now. In 2017, the company launched Apple Pay Cash, its peer-to-peer money transfer service that was built to rival the Cash App, PayPal, and Venmo. The service allows you to transfer money to friends and family right in iMessage and you can access and manage money transferred to you right in the Wallet app.

Then, in 2019, the company launched Apple Card, its own credit card that has taken on a long-standing industry that is ripe for disruption. In addition to integrating the card deeply into its devices and software experience, it continues to slowly add unique promotions and special financing options when shopping with the company. Apple Card has also received some of the highest customer satisfaction scores for the last few years.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

At WWDC 2022 in June, the company announced Apple Pay Later, its next financing service that would seek to combat services like Affirm, Klarna, and others in the growing Buy Now, Pay Later industry. While the service currently isn't expected to launch until 2023, it's another step into Apple building out a full offering when it comes to its financing services.

And, to wrap things up, Apple announced its new Savings account last week which, for now, will be limited to customers who have an Apple Card.

Apple is now five years into building out its in-house financial services offering and released or announced four major products in that category. If you don't see where this is going next, you haven't been paying attention.

What could an Apple checking account look like?

While there aren't any details leaking about Apple Checking (they'll probably come up with a better name than this) just yet, it's not hard to imagine what the base experience of a checking account from the company will look like.

Other modern financial services like the Cash App, PayPal, Venmo, and others have all taken swings at pivoting from a simple peer-to-peer money transfer service into trying to be your main bank account. Most of these other services have done so by, instead of pitching a boring old checking account, pitching a debit card with unique benefits that allow you to take your digital money and use it everywhere. You can even have your paycheck direct deposited into your new, hip account. Isn't that cool?

Apple's approach will likely be a little more muted than the approach that some other technology/finance companies have taken. Instead of offering flashy benefits, it'll likely lean harder into the ease of use an account with them would have. This wouldn't be a hard pitch being that it is arguably still the best at the "it just works" experience you get from Apple products. And, in the world of financial services, "it just works" is desperately needed.

In addition to tight integration with your other accounts and your devices, I wouldn't be surprised to see Apple lean in even harder with the financial wellness features it started to build when it initially launched Apple Card. There's a lot of room to bring some smarts to help people understand their spending and saving habits and do a better job at guiding them to ensure they are being financially responsible.

Adding the checking account is really more of a move to connect what already exists. Apple already has the Apple Cash debit card. It also has Apple Card Family which could easily be expanded to something like Apple Cash Family, enabling you to set up checking accounts for your kids that are easily supervised by the parent or guardian.

Where does Apple go after a checking account?

After the company, arguably inevitably, adds a checking account to its portfolio, I'm honestly not sure where it would go next.

At that point, it will have your checking account, your savings account, your credit card, and be part of almost every transaction you make between your debit card, credit card, and transactions using Apple Pay. The only other two areas it could go then is either deeper into lending or investing.

I don't see Apple as a place where you would finance your mortgage or get a car loan, so, if anything, I could see the company getting into the world of investing. Using the financial wellness approach it has used with Apple Card and would likely expand on with a checking account, investing could be another area that Apple could look to disrupt.

It already has Apple News and the Stocks app, so it has some of the features everyday investors use to try and educate themselves about stock trading and long-term investing. Such a service could integrate those apps into it and provide unique integrations with the stocks and funds you have in your "Apple Investing" account. At this point, however, I think we're pretty far away from something like that being a possibility.

The company has, however, over the course of the last five years, quietly built up all of the pieces it needs to be your main financial institution. There's just one piece of the puzzle missing — a checking account — and I'm sure Apple has its eye on it.

Joe Wituschek is a Contributor at iMore. With over ten years in the technology industry, one of them being at Apple, Joe now covers the company for the website. In addition to covering breaking news, Joe also writes editorials and reviews for a range of products. He fell in love with Apple products when he got an iPod nano for Christmas almost twenty years ago. Despite being considered a "heavy" user, he has always preferred the consumer-focused products like the MacBook Air, iPad mini, and iPhone 13 mini. He will fight to the death to keep a mini iPhone in the lineup. In his free time, Joe enjoys video games, movies, photography, running, and basically everything outdoors.