How Apple Card helps you live a healthier financial life

Apple Card isn't coming out until this summer, but it is poised to make a huge difference in the financial health of those who have struggled with responsibly using a credit card as part of their financial life. Credit cards have become part of almost all of our lives, and yet managing your credit card and understanding your spending is still something that most credit card companies haven't created good solutions for. This, along with subpar apps and surprise fees, has left many of us in more and more debt.

While some people have gone the way of cutting all their cards up and paying them off, swearing the credit card off forever, Apple is hoping to introduce something that may just hit the sweet spot when it comes to credit cards. A card that you can use easily, earn reasonable rewards, and most importantly fully understand your spending and pay as little interest as possible while paying none of the fees that are rampant across the industry. If we're going to live with credit cards, Apple Card might just be the product we need to become more financially responsible with them.

Weekly and monthly summaries

Apple has built everything you need to know about your Apple Card into the Wallet app, and you are able to quickly look at a weekly or monthly summary to better understand your spending. They've color-coded spending categories so, not only can you see which ones you have been spending the most in, but actually see a visual representation of what days that spending is happening. This will allow you to spot trends and understand more about when you are making decisions with your money that you want to change, and knowing is half the battle.

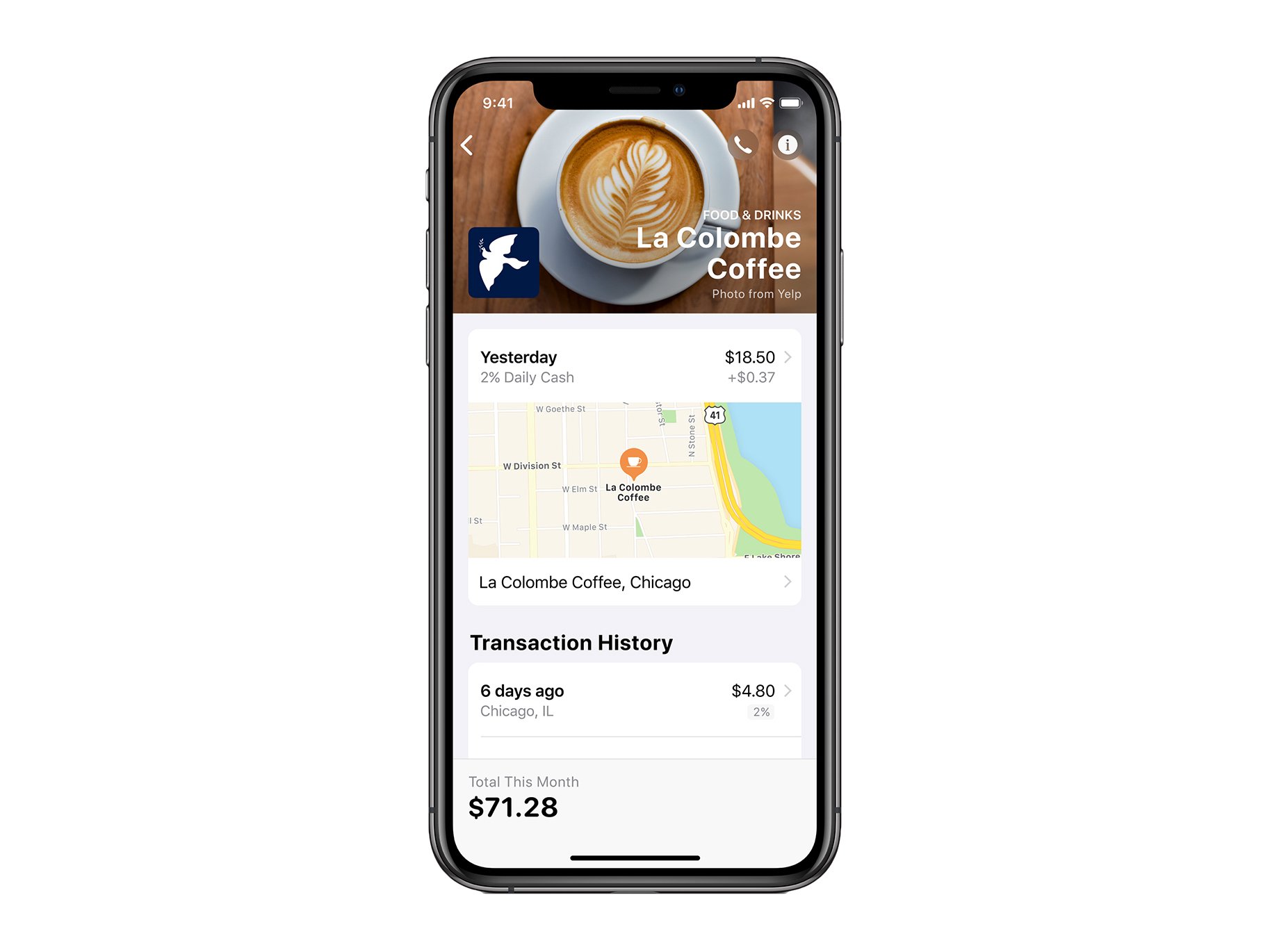

Works with Apple Maps

If you've ever looked at a transaction history for your credit card, you are bound to have come across a few charges that looked incredibly suspicious because of a name like Titan Transportation Inc, only to find out it was the Shell gas station. Credit card statements are riddled with these confusing merchant names that not only make us panic that someone has stolen our card but also make it difficult to track and understand where we are spending our money. Apple is changing this by fully integrating Apple Card with Apple Maps so that every time you use your card it pinpoints where you bought it and lists the store name along with its location on the map. You can see your full transaction history and a monthly total spent with that merchant as well, so if you're trying to break your addiction to your local pizza joint, Apple has your back.

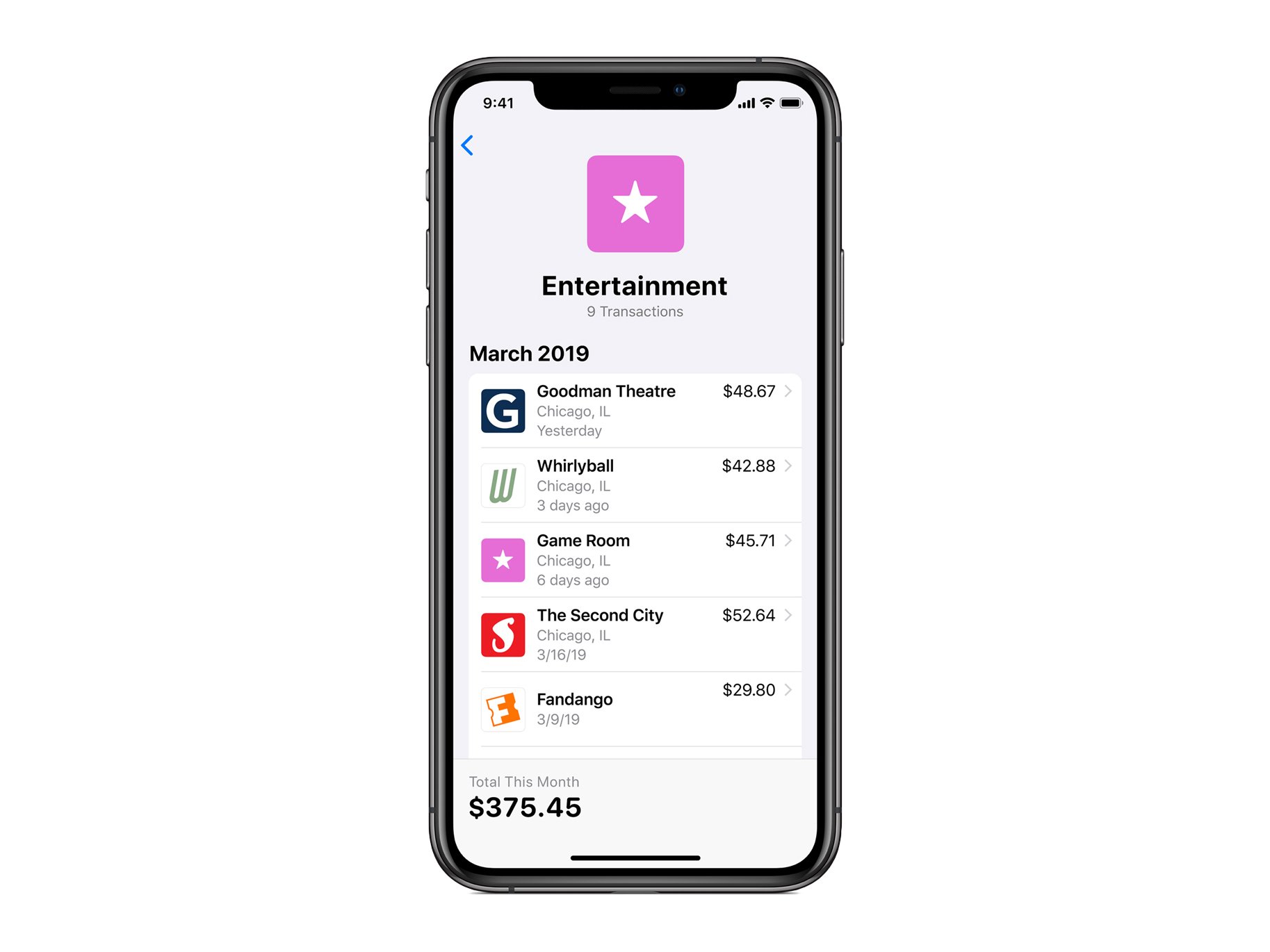

Spending categories

Setting a budget is one of the most important things you can ever do for your financial health. But in order to set and stick to a budget, it's imperative to understand where you are spending your money now. Apple is breaking down your spending with Apple Card into categories so that you can at a glance and in more detail know where your money is going. Things like Food and Drink, Entertainment, and Shopping are all broken out so that you can make more informed decisions. If you want to ensure you keep your spending on movies, music, and anything related to entertainment to a certain dollar amount every month, just pull up the category in the Wallet app to check to see where you are. It's easy to lose track of these things, and Apple Card is there to help you stay informed and on budget.

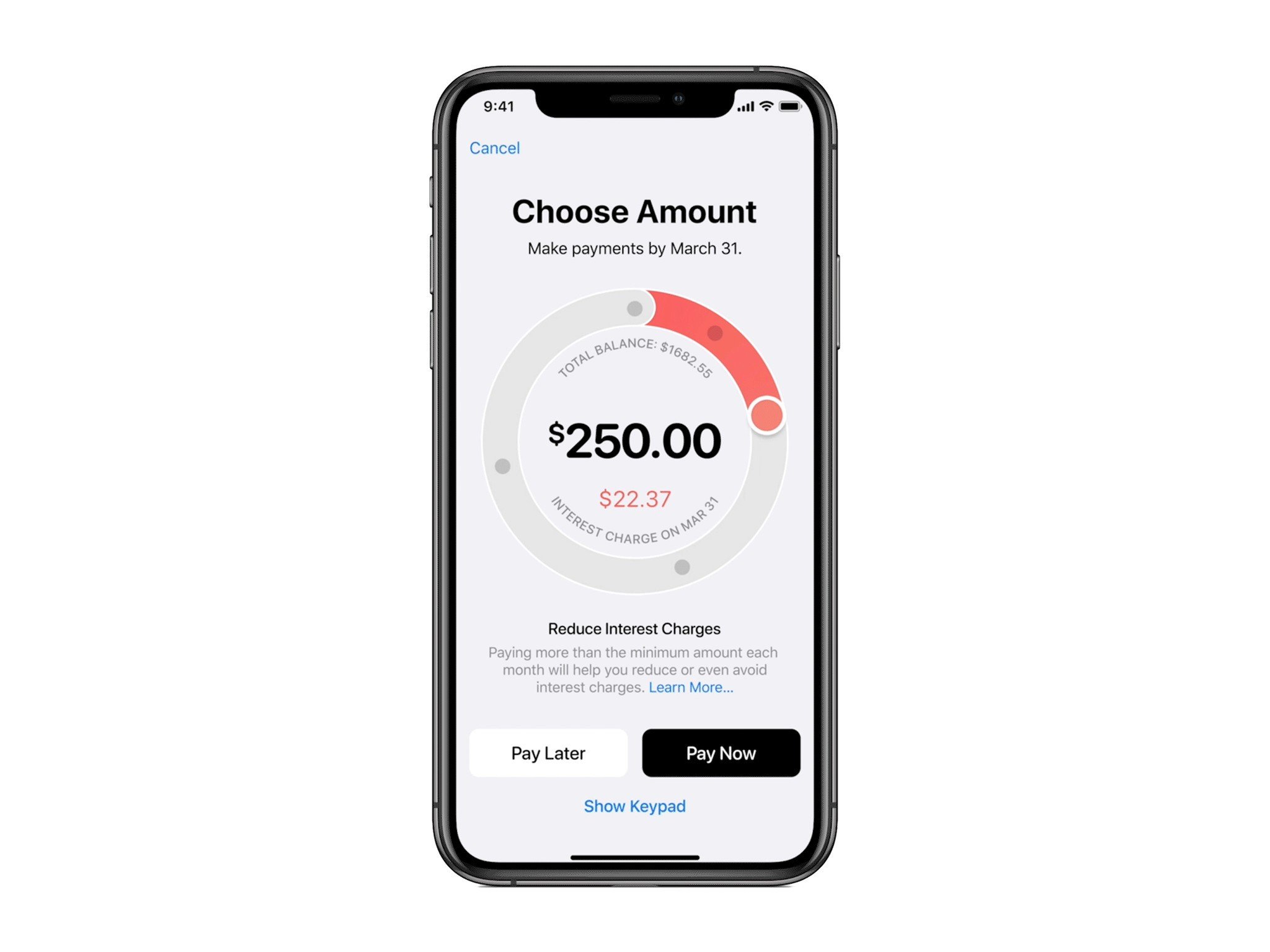

Transparent payments

One of the things that credit card companies have never done a good job at is explaining the impact of our credit card payments when it comes to interest. Most card providers make it difficult to know how much interest we are paying if we do not pay the balance in full, and I struggle to think of any who actively encourage us to pay less or none at all. Apple Card is going to exactly that. When you can't pay your balance in full, which it recommends, enter in how much you can pay and Apple Card will estimate the cost of interest. You can even move the payment amount around to see in real time how much the interest cost changes and Apple Card will even recommend you pay a little more than usual to save more on interest and pay off your balance faster. Apple is also allowing weekly and biweekly payments which can help you save even more on interest, as well as sending payment reminders to help make sure you never get behind on your bill.

Will it work?

Sticking with a financial plan is one of the hardest things any of us will do, and the credit card is easily one of the worst offenders in detailing us from that plan. Apple is hoping to change another industry by providing the tools and transparency that most have either failed or actively tried to keep from consumers, and it is a huge step in the direction towards consumer-focused financial services. If you have struggled with credit card debt, but don't want to go cold turkey, Apple Card is perhaps the best middle ground to either working your way out of credit cards or using them responsibly.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

If you want to learn more about Apple Card:

Apple Card: Everything you need to know!

How Apple Card compares to other cash back credit cards:

How does Apple Card's cash-back benefits compare to the best cards on the market?

With its sign-up bonus having just jumped to 60,000 points when you spend $4,000 in the first three months, now's the time to add the Chase Sapphire Preferred® Card to your wallet. Even better, future travel and dining purchases earn 2x points per dollar spent and it includes valuable travel benefits like primary car rental insurance. All of these extras make its $95 annual fee easy to justify.

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. iMore may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

Joe Wituschek is a Contributor at iMore. With over ten years in the technology industry, one of them being at Apple, Joe now covers the company for the website. In addition to covering breaking news, Joe also writes editorials and reviews for a range of products. He fell in love with Apple products when he got an iPod nano for Christmas almost twenty years ago. Despite being considered a "heavy" user, he has always preferred the consumer-focused products like the MacBook Air, iPad mini, and iPhone 13 mini. He will fight to the death to keep a mini iPhone in the lineup. In his free time, Joe enjoys video games, movies, photography, running, and basically everything outdoors.