How does Fitbit find its way back to fitness and financial success?

I've wanted to love Fitbit since long before the Apple Watch: I bought my first tracker (a Fitbit Zip) in 2012, in theory to help me stay active while working from home — but secretly because I wanted to see if a step tracker could track roller derby. I quickly found my answer: not if you don't plan to kill it with sweat in a few practices.

After my unfortunate experience with the Zip, I stayed abreast of Fitbit's offerings at work but didn't have the spare cash to justify getting one for personal use. And, of course, once I got an Apple Watch, any Fitbit hardware lust I had faded into the distance.

Muddling the message

The thing is, I still love Fitbit's message and community; it was one of the first companies to really capitalize on everyday fitness, focusing on getting people moving daily without needing to be a gym nerd. Like the Tamagotchi craze of the 90s, Fitbit made tracking your steps an obsession — and one that you could share with your friends. Fitbit's excellent app made connecting to your smartphone a piece of cake and viewing your data even easier.

But Fitbit struggles with retention. If people don't get hooked on the social network aspect or find enough value in the data, it's not unusual to see a user's Fitbit find its way to an abandoned drawer after a few months. Unfortunately, in chasing the holy grail — a tracker with enough valuable data to continually keep users hooked — it appears that Fitbit has lost its focus.

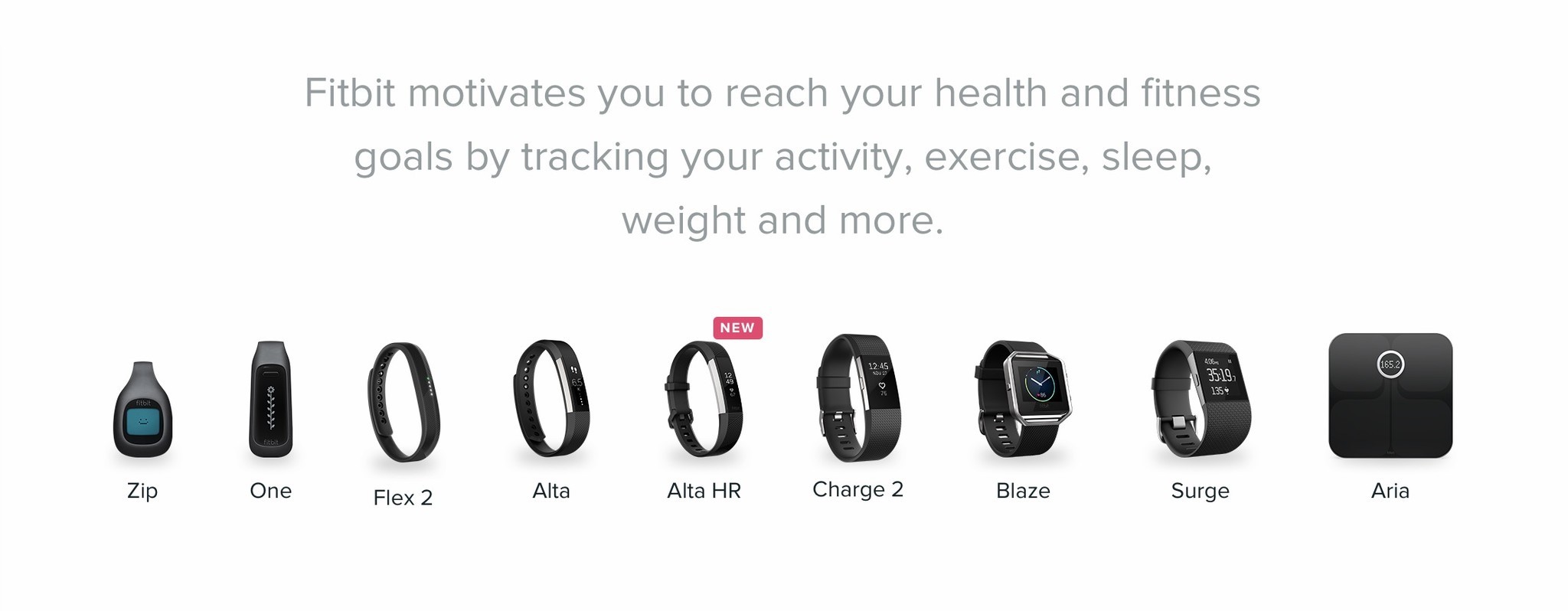

I look at the product line now and my head hurts:

I can figure out from sizes that these accessories are organized by least expensive to most, but beyond that, if I'd never heard of the Fitbit line, I wouldn't have the least idea which product to buy.

The Zip kind of looks like a Tamagotchi, so I'd assume (as a stranger) that it would track steps; both the Blaze and Surge kind of look smartwatch-y; and the One, Flex 2, Alta, Alta HR, and Charge 2 are… all bands with various thicknesses that probably track things?

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

From a consumer perspective, the whole line feels disorganized and split: Instead of adding new features to existing products, Fitbit has slowly grown its product line to encompass a sextet of circular bands and two clip-on trackers, all of which have slightly different features.

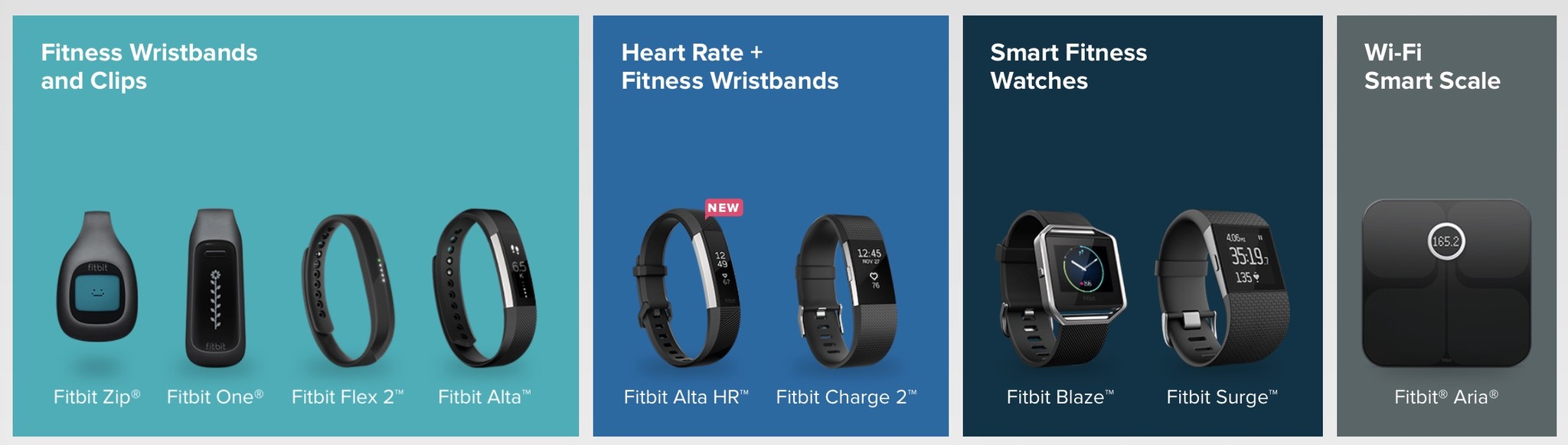

From the main page alone, I don't know who these bands are for. I don't know why I should buy them as a fitness newbie or a pro. The dropdown menu is a bit better, categorizing each into their main features, but I still don't know why I'd get an Alta over a Flex 2.

It's not until the product's individual page that you really get a sense of each's strengths and weaknesses: the Alta has a screen and HRM-enhanced sleep tracking over the Flex's lack thereof; the Charge has GPS and fitness level tracking while the Alta HR just adds a heart rate sensor.

But even there, I look at Fitbit's lineup and I shake my head. The Flex, Alta, and Alta HR are separated in price by $49.95 ($79.95 if you go for the HR's special color editions). Are users so fickle that they need three different price points for tiny extra features (sleep tracking and heart rate)?

Company in crisis

As much as it pains me, a lot of balls in the air does not a professional juggler make. And Fitbit is a company made up of a lot of moving parts.

It's trying to compete in software with its Fitbit social app and Fitstar and Fitstar Yoga exercise programs. It targets casual fitness users with the Zip, One, Flex, and Alta. The Alta HR, Charge, and Surge offer advanced fitness tracking, while the Blaze offers a cheaper alternative to the fitness smartwatch. It's even supposedly working on Beats X- and Jaybird-style exercise headphones.

In theory, having many active products in development isn't necessarily a terrible thing; diversifying allows you to keep from ending up a one-hit wonder. But Fitbit's current line isn't so much trying to diversify as it is lacking focus. In trying to constantly capture the fitness narrative, the company has been repeatedly reinventing the wheel — building product after product from scratch without taking lessons and workflows from the previous model.

Sales flagged in 2016, despite the company's two newer high-end trackers, the $200 Blaze smartwatch and $150 Charge 2 (which iMore writer Luke Filipowicz previously described as "a fitness tracker on steroids"). Though Fitbit shipped over one million Blaze trackers a month after its official release, by the end of the year Fitbit had to let 107 employees go due to Q4 earnings losses.

I had hoped that this served as a wakeup call for Fitbit. At the end of March, Fitbit formally reorganized its leadership team, with Chief Business Officer Woody Scal and EVP of Interactive Tim Roberts departing the company; both had joined the company in its early days. Roberts oversaw software and design, including many of Fitbit's social projects and third-party integrations.

The company also promoted Samir Kapoor to Senior Vice President of Device Engineering (from his former VP role), and hired a new EVP of Operations, Jeff Devine, to "[streamline] the integration between firmware, hardware and advanced R&D, with the goal of speeding up the company's product development process."

In addition, Fitbit announced that it was focusing its products around two major categories: Consumer Health and Fitness, and Enterprise Health (focusing on providing more accurate health tracking data to insurance companies and other health providers).

Whatever changes have been made internally, however, they have yet to affect the company's external presentation. Fitbit still has a lineup replete with different trackers. Spring 2017's Alta HR tracker replaced the older Charge HR, but both the original Alta and Charge 2 remain active products.

Additionally, Yahoo Finance reporter JP Mangalindan claims that the Fitbit Blaze's smartwatch successor continues to be riddled with delays, pushing launch back to Fall 2017 at the earliest.

"In one of the more final prototypes, the GPS wasn't working because the antennae wasn't in the right place," one of those sources told Yahoo Finance. "They had to go back to the drawing board to redesign the product so the GPS got a strong signal."Fitbit's design team also ran into problems making its smartwatch fully waterproof, even though that's a key design element for the Apple Watch Series 2. Indeed, it's still unclear as of the publication of this article whether the device will launch with the waterproof feature. If it isn't waterproof, critics may perceive it to be an inferior product to Apple's — especially given that the device will launch roughly a year after the Apple Watch Series 2.

Mangalindan also reports that the watch will have a similar build to the rather clunky Blaze, which — like many smartwatches before it — wasn't great for small wrists.

Fitbit's desire to continue to compete with the Apple Watch makes sense from a logical perspective: As one of the originators in the tracking space, the company sees the potential for both profit and adding more fitness professionals to its community. And this isn't the first time a Fitbit product has been delayed; almost all the company's trackers have had internal hardware hiccups that required dropping features before launch.

But in throwing so many resources at this one problem — an issue that Fitbit may not even be well-equipped to solve — the company is neglecting what made it popular in the first place: simple, easy, and fun fitness tracking.

The power of fun fitness

Like Apple, Fitbit's strongest asset is in its software. The Fitbit app is fun to use and builds community and camaraderie amongst your friends; at the end of 2016, Fitbit reported 23.2 million active users and claimed the title of the largest social fitness network in the world. Additionally, Fitbit's 2015 Fitstar acquisition provided the company with the resources to help its users train and see measurable improvement.

Between its scientific resources, social network, and training options, Fitbit has the potential to deliver users (and companies) with smart, specific data that truly helps them improve their lives. But for the company to be able to process that data, people either need to be using Fitbit hardware, or Fitbit needs to change its policies about hooking into third-party systems like the iPhone's Health app or the Apple Watch.

Ultimately, if the company plans to continue in the fitness space, it needs to distinguish itself from its competitors and prove what makes Fitbit a brand worth buying. The company may not currently see smaller startups like Misfit as a threat, but if they keep iterating while Fitbit stays stagnant, there will soon be a problem.

For instance, Misfit's newest tracker, the Flare, takes direct aim at the Zip, One, Flex, and Alta. Like Fitbit's entry-level tracker, it's just $59.99 and offers up to four months of battery life, but also offers a capacitive touch screen, a sleeker look on your wrist, water resistance to 50 meters, taggable activity types, and sleep tracking. It also offers limited functionality with your phone, letting you customize its side button to control devices or snap a photo on your phone. To get all of these features in a Fitbit, you'd need the $130 Alta. Worse, the $59.99 Zip looks positively archaic when compared to Misfit's newest tracker.

But anyone can make a new low-end tracker. What's most interesting is Misfit's software pitch: You can upgrade the water-resistant Flare to track your swimming laps with an in-app purchase. On its own, it's a tiny gimmick, but in the larger scheme of the world, in-app purchases and subscriptions have proven extremely successful at continuing to hook users into an ecosystem where they might otherwise have gotten bored or tired of the product.

Where does Fitbit go from here?

Right now, Fitbit still has the edge with its software and community, but that's not going to last if the company isn't careful.

There is so much potential in an interconnected device that helps you actively manage your fitness and health, but trackers have so far publicly focused on gamification and data fetishization — challenge your friends, track your steps. Fitbit has a ton of smart people working on making the software more powerful, and the company's venture into Enterprise Health makes me think executives are aware of the potential power of health data on a companywide scale. But the company isn't alone. Apple and Google have both put significant resources into building their health and fitness teams, hiring doctors and engineers to better understand how people can track their information, visualizing it effectively, and what parts are most important.

If Fitbit can't figure out how to balance its software, entry-level hardware, and smartwatch goals, it may well be relegated to a drawer — eclipsed by the Apple Watches, Gears, and even Flares of the fitness world.

Serenity was formerly the Managing Editor at iMore, and now works for Apple. She's been talking, writing about, and tinkering with Apple products since she was old enough to double-click. In her spare time, she sketches, sings, and in her secret superhero life, plays roller derby. Follow her on Twitter @settern.