The State of Fitbit: Rapid growth and oncoming challenges

Jan Dawson is the founder and Chief Analyst of Jackdaw Research, an advisory firm focused on the consumer technology industry, from smartphones and tablets to music and video services to cloud storage and e-commerce. Jan follows Fitbit and was gracious enough to share his thoughts with iMore. — Ed.

Fitbit is the market share leader in fitness wearables. It sells more fitness devices than any other company each quarter, and has continued to do so even as Apple and a variety of Android vendors have entered the smartwatch market above it, and as Xiaomi and other low-end competitors have launched cheap wearables below it. Yet there are reasons to be concerned about the long-term viability of Fitbit's business.

Rapid growth and great margins

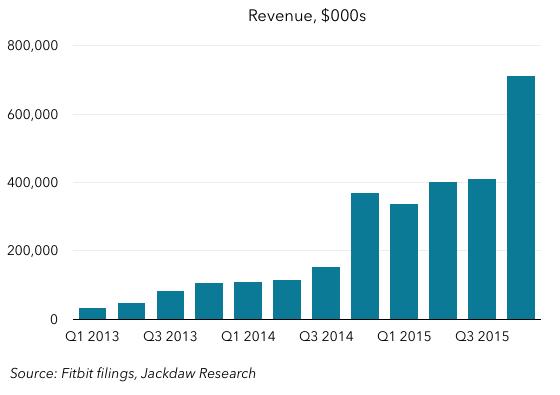

One of the most impressive things about Fitbit's performance is its ability to continue to grow at a rapid rate in a market where few others seem to be able to sell much of anything. In the fourth quarter of every year, Fitbit achieves a step-change in its revenues that's unlike almost any other consumer electronics company I can think of. It has regularly posted over 200% year on year growth in revenues, and this past fourth quarter posted an impressive 92% growth in revenues and 56% growth in devices sold compared with the fourth quarter in 2014. Fitbit revenues

Perhaps equally impressively, Fitbit's margins have remained healthy despite this rapid growth. Given that consumer electronics companies are generally lucky to achieve high single-digit operating margins, the fact that Fitbit's margins have been in the 20s for most of the last two years is quite something. Taken together, the rapid growth and decent margins suggest that Fitbit has managed to differentiate itself successfully despite increasing competition. In that sense, it looks a lot like Apple, another company which has been able to drive high growth and maintain margins even in the face of lots of products which nominally do the same thing at lower price points.

Growth challenges coming

Despite all those heartening metrics, though, there are several signs that Fitbit's future might be more challenging than its past. One of Fitbit's biggest challenges throughout its history has been the high abandonment rate associated with fitness devices, something that's been equally true for large devices like treadmills and more personal devices like wrist bands. When Fitbit first went public, I did some analysis that revealed that the company's active users at any given point in time were around 50% of its registered users – in other words, around half of those who had registered a device had stopped using it regularly. I also calculated that the average user abandoned their device after around six months of usage.

There are signs that Fitbit's future might be more challenging than its past.

More recent numbers suggest that Fitbit has been seeing slightly lower abandonment rates, but it still only retains around 58% of its users long term, and in 2015 alone, 28% of those who bought a device had stopped using it by the end of the year. This is a real challenge for a consumer electronics company, most of which trade heavily on user loyalty and the ability to upsell existing users with new devices. In Fitbit's case, many of its users stop using the device they have long before they might consider upgrading to a newer or better one. That means that, in order to keep selling more Fitbits, the company has to keep finding new customers, something that seems unlikely to be sustainable over time. One of the other wrinkles is that three quarters of the company's revenue comes from the US, something that hasn't really changed over the last several years. The high abandonment rate is even more problematic if Fitbit can't expand its addressable market outside the US significantly.

Presumably at least partly in response to all this, Fitbit has been ramping up its sales and marketing spending significantly over the past year. Even though sales grew strongly, sales and marketing spending at the company grew from 10% of revenues in 2013 to 15% in 2014 and 18% in 2015. In fact, it spent more on sales and marketing in 2015 than it made in revenue in 2013, and a lot of that went to TV advertising for the first time. All of this reinforces the sense that Fitbit is having to work harder and harder to find new customers and convince them to buy its devices, something that also feels unsustainable over the long term. As a result of this higher marketing spend, those impressive margins we mentioned earlier have actually dropped over the last couple of quarters, down to the mid-teens.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Fitbit is straying out of its niche

One thing that's worth noting about Fitbit is that it now sells a range of fitness devices, priced from $60 to $250. But its average selling price has remained stubbornly under $90, suggesting that its customers see most value in its lower-end devices, which perform basic functions well. Incidentally, this means that even though Fitbit is the market share leader by shipments, Apple generates significantly more revenue from its wearables than Fitbit.

Blaze looks like an attempt to leave Fitbit's comfort zone and go head to head against an increasing array of attractive smartwatches.

All this is what makes its recent decision to launch its first smartwatch, the Fitbit Blaze, so baffling. The Blaze looks like an attempt to leave Fitbit's comfort zone and go head to head against an increasing array of attractive smartwatches from Apple, Samsung, LG, and a variety of other Android vendors. And yet the device itself is clunky, ugly, and lacks many of the features of those true smartwatches. Investors didn't like the announcement – they sent the stock sharply downwards on the news – and gadget reviewers haven't been all that impressed either.

It's understandable that Fitbit wants to expand its market by moving into new segments of the wearable industry, but this is exactly the wrong strategy to pursue. It's been successful precisely because it's created and defended a niche between the cheap knockoffs and the premium smartwatches offered on either side of it. If Fitbit is to continue to grow as it has in the past, the answer doesn't lie in expanding into more wearables categories, but using its devices to create more of an ecosystem. In this sense, Fitbit faces to a great extent the same challenge as another single-category company: GoPro. Both companies suffer from the fact that they make essentially one product (albeit in different versions), with limited total addressable markets, and increasing competition from smartphones and smartphone makers.

The bottom line

What Fitbit needs to do is build other products and services around its devices business, both to make it more defensible competitively and to provide more opportunities for growth. That likely means partnering with other companies as well as developing new organic capabilities and potentially acquiring capabilities it can't grow in-house. That's a big shift from the company's strategy up to this point, and it's going to be a tough transition, but it's arguably necessary if the company is going to continue its past trajectory.

○ Fitbit Buyers Guide

○ Fitbit Users Guide

○ The Best Fitbit to Buy

○ Fitbit News

○ Fitbit Forums

○ Buy on Amazon

Jan Dawson is the founder and Chief Analyst of Jackdaw Research, an advisory firm focused on the consumer technology industry, from smartphones and tablets to music and video services to cloud storage and e-commerce. Jan also regularly writes for the Jackdaw Research blog, Beyond Devices, as well as for Techpinions, and is a contributor to both Recode and Yahoo Finance. You can find Jan on Twitter at @jandawson.