Understanding Apple beyond the iPhone market

Despite the usual doom and gloom reporting that we got leading up to Apple's Q3 2019 financial results -- or stock manipulation, depending on your point of view -- the company managed to largely beat expectations, but not escape the doom and gloom, at least not entirely.

I get that people in press that are glass half empty, and some, like myself, who tend towards glass half full, but increasingly, all we're seeing is glass smashed and all that tasty beverage spilled out all over the table. That's just a waste of good beverage.

iPhone revenue was down 12 percent year-over-year, but the active install base -- those billion phones in our pockets, y'all -- was up, thanks to switchers, upgraders, and new customers alike. Mac and iPad were both up.

Services revenue, which includes Apple Music and Apple Care, was up 13 percent. Wearables, which includes Apple Watch, AirPods, and Beats, was up 50 percent. So, what's the problem?

Depending on how you tilt your head and squint, factoring in seasonality and a myriad of other factors, for the first time since 2012, the iPhone accounted for less than half of Apple's revenue, and where Apple was previously accused of being far too dependent on iPhone sales, now, going beyond the iPhone is seen as just as worrisome and troubling.

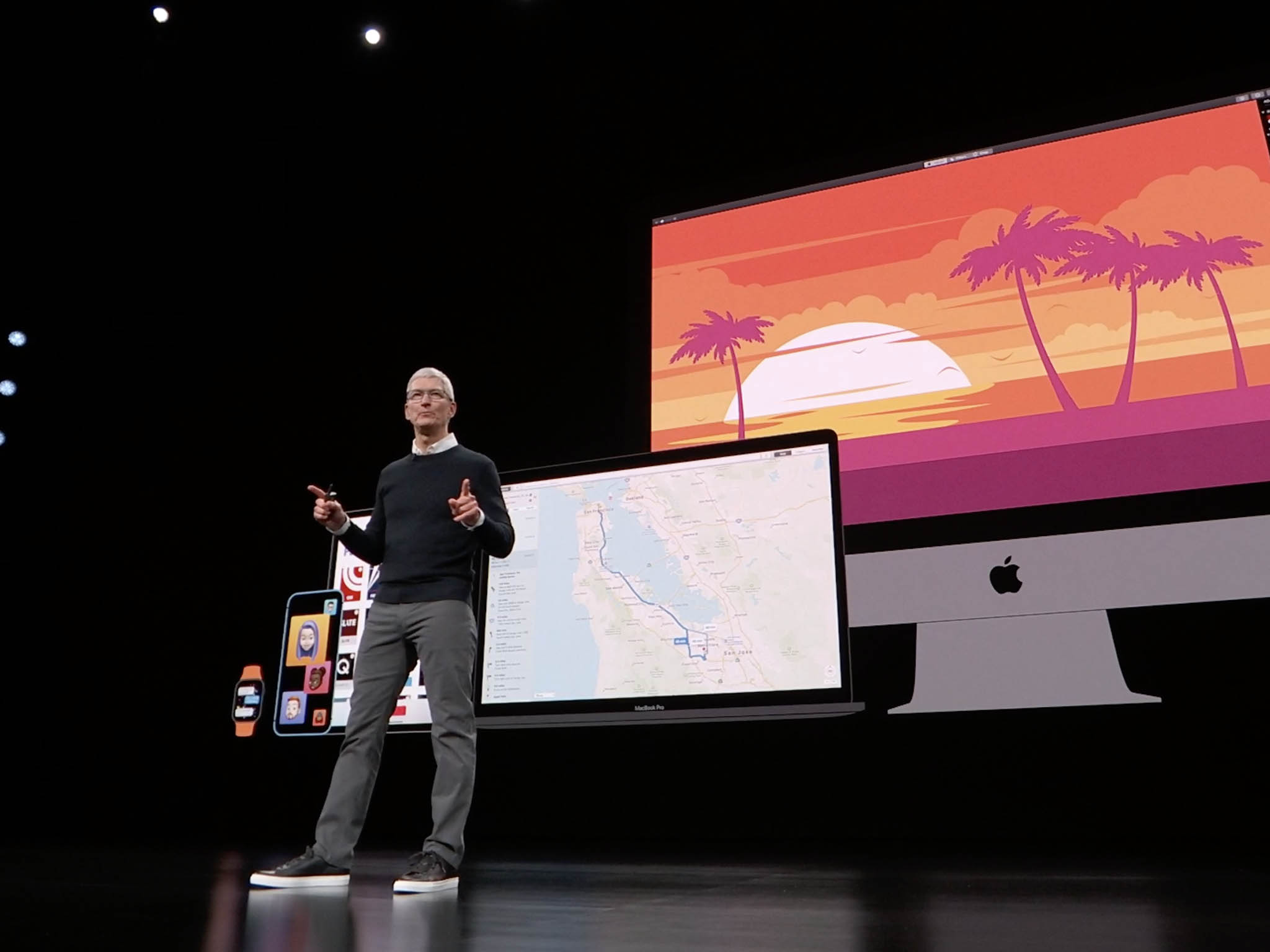

The age of iPhone is over, or the post-iPhone age is just beginning. Since then, there's been just so much noise and so much dumb, I just wanted to do something smart. I got analyst Neil Cybart, of Above Avalon," on the line to help us sort it all out.

Neil: I think what tends to happen is a lot of the earnings previews that are out there, they focus on just a few big numbers. They'll maybe look at iPhone revenue, and they'll see that it's down, and that's about the extent.

Master your iPhone in minutes

iMore offers spot-on advice and guidance from our team of experts, with decades of Apple device experience to lean on. Learn more with iMore!

Then the rest of the article is trying to explain, why is it down, and what is Apple trying to do in response? I think in reality, when you take a closer look at the results, and you look at, OK, what's going on with the wearables business?

What's going on with services? Even what's going on with the iPad and Mac, which are surprisingly showing quite a bit of stabilization, especially for the iPad. That's when you get a different picture. I think you get a more detailed overview of what's really going on.

You'll find there's a lot more moving pieces at play. I do tend to think some of the narratives that are out there, they're off the mark, because they're not able to capture all of those moving pieces.

Rene: When people start to talk about, "We're entering the post-iPhone age," does that resonate with you? If so, what are they trying to say by that?

Neil: I think a lot of the post-iPhone narrative is about where will Apple turn to next for growth, or where will they generate revenue going forward? In that respect, I think it's logical that a lot of people are making that claim for this quarter, simply because of what's going on.

We have the non-iPhone part of the business doing well and the iPhone business struggling in terms of growth. What happened was each basically offset each other. I think a little bit differently, though, about this narrative of post-iPhone era.

I'd go back to when Apple began working on different product categories, like wearables, like revamping the content distribution arm. That started a while ago. Apple Watch launched in 2015. We have AirPods out for a couple of years now.

I think this past quarter, it wasn't the start of some new era at Apple, some new post-iPhone period. I think it's just the latest sign of what Apple has been working toward. What you see Apple doing is saying, "Well, here are additional devices that you will likely enjoy so much that you're willing to pay for, and here are additional services as well."

Apple wants to control a little bit more about what we do on those devices. It's one thing just to have more than 1.4 billion devices, but we're doing a lot on those devices. We're giving those devices more of our time throughout the day.

Apple's starting to say to themselves, "We think there's some areas for us to play a bigger role in how you use those devices." I think you're starting to see...There's certain metrics that I follow maybe you could look at.

Average revenue per user, you're looking at the entire Apple install base. Then you could break that down into just the iPhone users, or maybe just people who enter the Apple ecosystem through the gray market. Maybe they bought a used or a refurbished iPhone.

What you're seeing Apple do is launch all of these new products and services. I think people are slowly, or maybe gradually, becoming more engaged with the ecosystem. That is something that we're seeing play out quarter after quarter.

Again, it's not something that you're going to see all at once, but maybe over the span of two or three years, it's going to add up. I think that's what's happening with wearables and also services.

Rene: When you look at the iPhone business now, when you look ahead into the near-term future, where do you see it?

Neil: I think the big issue with the iPhone right now is that people are holding onto their devices longer. It's not too surprising, because as a new iPhone comes out, I think in some ways, it's handling our use cases.

It's doing a much better job at handling our current use cases. Whereas a couple years ago, maybe we had the tendency of going out and upgrading every year or two, on average, it's longer. You're seeing that play out from a unit sales perspective.

I think the other issue here, which is a little bit harder to gauge, is the global economy, and where you have foreign currency impacting prices. On one hand, in the US, we're familiar with iPhone prices. Everyone focuses on, say, the $1,000 iPhone.

In many countries, prices have been much higher. I do think that has played a role in people saying, "Well, wait a second. I'm probably not going to upgrade my iPhone this year. This price is now a certain level."

You're seeing Apple do things like price cuts outside the US, really just to try to bring that pricing back to levels that here in the US, we're used to. They're also doing a little bit more in the way, or a lot more, in the way of juicing those trade-ins.

We know that a lot of people buying iPhone in 2019, they have an iPhone already. What do you do with that iPhone? Trade it in. Apple's trying to make it seem like, if you trade it in, the price for the new one is a lot lower.

I think what's happening is you're seeing demand actually improve. It's still down. Unit sales, my estimate is it's probably down around between 5 and 10 percent on a sell-through basis. I do think that's actually going to improve a little bit as we go forward for the next couple of quarters.

This is just an inevitable thing with financial modeling. When you have a really bad quarter one year, the next year, it's an easier compare. I think once we start into 2020, Apple's going to be facing that what was really a bad quarter in the first quarter and continue to the second quarter.

It is possible that the iPhone business actually starts to stabilize a tad. My estimates have iPhone revenue still down in 2020, but maybe not by much. Again, I'm not making too many claims in terms of a 5G iPhone causing a huge rush in upgrades.

I know some analysts like to still push the mega upgrade cycle. I'm not one of those. I tend to think that we are simply going to hold onto these phones for longer as time goes on. I think what ends up happening is, just given the size of the install base, even if the upgrade rate slows, there's still a lot of people out there that are going to upgrade.

You have somewhere around, what's my latest estimate? Something, probably 925 million iPhones out in the wild. That's a lot of people. Even if you assume the average person holds onto it three or four years, that's going to kick off a certain number of upgrades every year regardless.

Yes, a lot of people made, they noticed this past quarter that the non-iPhone business was actually more than the iPhone business. It's a little bit trickier, because the third quarter is typically the weakest for the iPhone business.

That may not continue, say, next quarter, or especially for the first quarter. That's the big one for the iPhone. I think it's correct to look at that big picture and say, "Yes." You start to see what's happening here. That is that newer product categories, where Apple's been putting a lot of R&D in wearables, content distribution services, those are gaining momentum.

With the iPhone business, even if it stabilizes, which I think is good for Apple, you're still going to have that non-iPhone business show stronger growth, both in terms of the absolute dollars and the percentages.

You could say that maybe this quarter was a peak of what we're probably going to expect going forward.

Rene: Where does the Mac then fit into this for you? Apple is relatively unique. Microsoft was not able to create a new platform. They've had to bring Windows and the PC forward into the mobile age, where Google never had a traditional computer platform.

They started with Android and with Chrome, and they exist fully in the modern mobile age, where Apple has to straddle both worlds, sometimes to the benefit, and sometimes, one against the other. Yet the Mac still seems to be going strong for them right now.

Neil: It's been fascinating to see, I think you could call it, an evolution in how they're approaching the Mac. There's a good amount of evidence to say that they've made some major changes to the way they're approaching the category in recent years.

I tend to think of the Mac as they want to position it as a content creation platform for use cases that may not have necessarily a home on something like the iPad, which I do also think Apple is positioning over time as a content creation platform.

In some ways, you see Apple, they've decided that they're going to push both the iPad and Mac at the same time, push it forward. I think a couple years ago, it was a little bit different, where I think Apple, I describe it as they were pulling the product categories forward.

The Mac was at the end of that rope. I think it was at risk of falling off the rope. I do think they're getting more aggressive. That could be seen with more of a sustained schedule for upgrades or updates.

I do think you're also going to see new models. This idea of, well, maybe the iPad starts to eat a portion of the Mac, again, maybe a couple years ago that argument was stronger. Now, I do tend to believe them when they say that the Mac's future, if you're a Mac user, is looking brighter.

From my perspective, the question is how do you grow the Mac install base? I do think that's more challenging for Apple. I tend to think, if you're comparing the Mac to iPad and iPhone, there's not going to be any catching up.

You're going to have the iPhone at multiple times the size, in terms of ecosystem, in terms of install base, versus the iPad. I do think the iPad's going to be multiple times the size of the Mac. As we saw at WWDC in that demo room, they're clearly targeting the Mac not just at a portion of content creators, but a very, very small portion.

Rene: They seem to have pushed really hard on the mainstream at the expense of the very high-end pros, and now, it seems like they're focusing on the very high-end pros. I'm not sure what that means for the mainstream yet.

Neil: I think that's totally right. That's the other thing. When you look at the sales for the Mac, those lower end models continue to sell really well, and I think the most surprising thing about the Mac is about half of sales are going to people new to the Mac.

I hear from a lot of people who are long-time Mac users, they're still using older devices. They're using those older MacBook Pros. If you do see Apple become aggressive with updates, maybe make some changes to the keyboard, you could see even a surge of upgrade.

Rene: I'm going to wait for the first analyst to say, "Keyboard supercycle."

Neil: Correct, yeah. [laughs]

Rene: Last question. As you look into Q4, and then beyond that, Q1, and potential devices from the September event, maybe another October event, new iPhones, new iPads, new Apple Watches, what are you going to be looking for?

Neil: I think whenever you're looking at a new iPhone, or you could say an Apple Watch, I'm always interested in, is that new device better than last year's device? I know better is a subjective term.

I'm thinking, if you are using that newest iPhone, that newest Apple Watch, do you still have an urge to go back and use an older model? If the answer is no, and that means that the newest iPhone, the newest Apple Watch is truly the best, I think that's a very important thing.

That tends to get lost in a lot of the financial discussion, because everyone's focused on unit sales. They're focused on upgrading. Especially for the iPhone, Apple is at that tricky point where you don't want to over-serve users here.

We can even look at the camera. A lot of people are satisfied with the camera that they have. It's going to be very interesting to see, how do they go forward in terms of having new features, bringing new technology that people say, "You know what? I actually have a use for that in my life. I think I may want that newest device."

It's going to be easier to do with the Apple Watch, just because it's a newer product. You're going to see larger upgrades year-over-year. That's the thing that I've been focusing on, the iPhone in particular in recent years.

Then, of course, I am looking for those surprises. That is, do we see Apple expand the wearables platform? That would be in the near term, I'm primarily looking at...I call the wearables, I think of it as battles for real estate on our body.

The smartwatch is a battle for real estate on our wrist. Wireless AirPods, real estate for our ears. It's possible that Apple will expand its product lineup for the year. I think that's going to be really interesting to consider when you're thinking of the wearables platform, where all of these devices are coming together.

If you have an Apple Watch, are you a little bit more likely to buy that pair of wireless AirPods? I tend to think the answer is yes, or maybe even if vice-versa. If you have a wireless AirPods, you're more likely to buy another wearables devices.

That's something I'm considering when the fall comes, and you do have traditionally Apple's product upgrade cycle, trying to everything ready for the holidays. I do also think that my attention's going to be on some of these new content distribution services. There's still things that we don't know about Apple TV Plus.

Rene: Pricing.

[laughter]

Neil: The clues would suggest that they're going to charge something. I think there were some people thinking that, how were they going to compete with something like Disney and all of these other direct-to-consumer streaming bundles?

Rene: Anyone with catalog content.

Neil: Right, exactly. You're going to have Apple come out with a pretty limited amount of content launch. How is that going to impact pricing? I think the big question is do you see some type of bundle?

Right now, if you are engaged in the Apple ecosystem, you're starting to have a lot of Apple subscriptions. You have different renewal dates. You got to keep track of everything. The case for an Apple bundle is getting stronger, where you just, your whole family can subscribe to all of these different bundles.

You can throw in a discount in there, if you subscribe to multiple bundles. I will be watching that in the coming months to see if there's any clues. Of course, Apple Arcade, we don't have pricing for that, either.

As it stands now, it's shaping up to be a pretty busy September into October. That's the other thing. When you look at guidance for first quarter, for the fourth quarter 2019, guidance was pretty decent. That would suggest that, I think my estimate is, Apple is probably expecting overall iPhone sales to be maybe down a little bit, just by five percent.

Of course, the timing is a little bit different. Last year, you had one iPhone model launch in October. That threw things off from the quarterly financial perspective, but things do appear to be shaping up that you're going to have a pretty decent September in terms of new products.

I think a lot of people are probably going to be waiting for that.

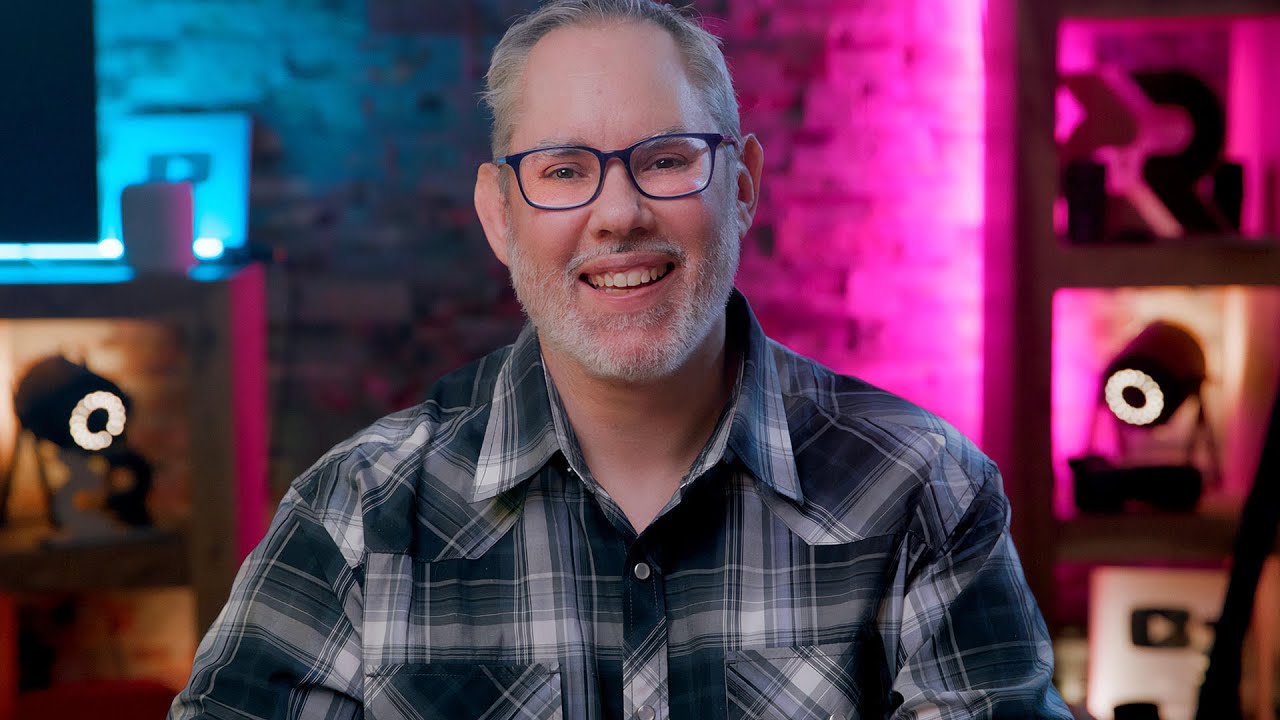

You can find Neil @neilcybart on Twitter and subscribe to his site and newsletter at AboveAvalon.com

Rene Ritchie is one of the most respected Apple analysts in the business, reaching a combined audience of over 40 million readers a month. His YouTube channel, Vector, has over 90 thousand subscribers and 14 million views and his podcasts, including Debug, have been downloaded over 20 million times. He also regularly co-hosts MacBreak Weekly for the TWiT network and co-hosted CES Live! and Talk Mobile. Based in Montreal, Rene is a former director of product marketing, web developer, and graphic designer. He's authored several books and appeared on numerous television and radio segments to discuss Apple and the technology industry. When not working, he likes to cook, grapple, and spend time with his friends and family.